Three months ago (Oct 2022), Indian billionaire Gautam Adani, said to be the richest person in Asia, was reportedly in talks with Singapore’s Temasek Holdings and GIC, to raise at least US$10 billion to fund its business expansion.

The Adani Group wanted to invest more than US$100 billion over the next decade, most of it in the energy transition business, Adani announced.

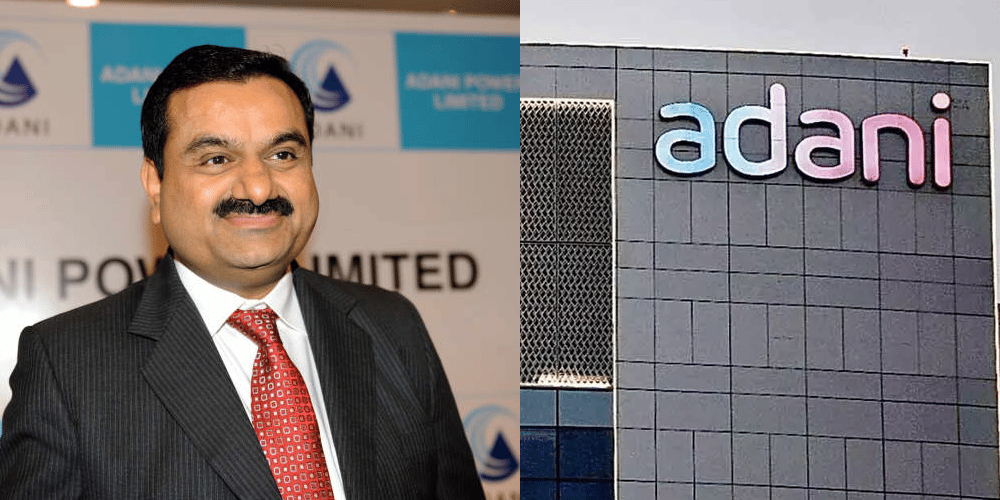

Adani is seeking to raise his international profile and is aggressively branching into new businesses in India, where he is seen to enjoy a close relationship with PM Narendra Modi.

Adani’s executives personally flew to Singapore to talk with Temasek and GIC, after meeting with other investors. The plan was to raise the capital in multiple tranches, likely through the sale of stakes in the group’s firms or associated entities.

At the time, when asked by Reuters about the meeting, Temasek said it does not comment on market speculation and rumours.

US investor alleges ‘brazen’ fraud in Adani Group

On Wednesday (25 Jan), US investor Hindenburg Research publicly accused the Adani Group of “brazen” market manipulation and accounting fraud. Shares in companies of Adani Group fell immediately.

Hindenburg Research, a prominent research outfit which specialises in activist short selling, made wide-ranging allegations of corporate malpractice following a two-year investigation into the tycoon’s companies.

Hindenburg’s report details a web of Adani family-controlled offshore shell entities in tax havens – including the Caribbean, Mauritius and the United Arab Emirates – that it claims were used to facilitate corruption, money laundering and taxpayer theft while siphoning money from the group’s listed companies.

In 2020, Hindenburg brought down the founder of e-truck company Nikola Corp, which was accused of concocting “dozens of lies”. Nikola founder Trevor Milton eventually stepped down as chairman and was found guilty of securities fraud. More recent targets of Hindenburg’s include Clover Health and Lordstown Motors.

The short seller stressed that its report “represents our opinion and investigative commentary” and urged readers to draw their own conclusions about Adani Group.

Hindenburg said in its report with regard to Adani’s companies, “Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its seven key listed companies have 85 per cent downside purely on a fundamental basis owing to sky-high valuations.”

Indeed, Adani’s companies trade at price-to-earnings ratios many times those of peer companies in India and around the globe.

Investors and analysts have also flagged concerns over the high levels of debt seen in the empire’s listed units. Gross debt at six Adani companies – Adani Enterprises, Adani Green Energy, Adani Ports and SEZ, Adani Power, Adani Total Gas and Adani Transmission – stood at 1.88 trillion rupees (S$30.3 billion) as at end-March 2022.

In response, Adani Group’s CFO Jugeshinder Singh condemned the report published by Hindenburg, saying that it is “a malicious combination of selective misinformation and stale, baseless and discredited allegations”.

Corruption remains endemic in India.

According to Transparency International, an NGO which works closely with the UN, 89% of people thinks government corruption is a big problem in India while 39% of Indian public service users have paid a bribe in the country in the past 12 months.