By Singapore Armchair Critic

This article was first published at Singapore Armchair Critic

In his 2013 Budget announcement earlier this year, Deputy Prime Minister Tharman Shanmugaratnam said the government would look into lowering Singaporeans’ out-of-pocket health spending.

On Sunday evening, we learned more about how this may be achieved through Prime Minister Lee Hsien Loong’s 2013 National Day Rally (NDR) speech. In summary, these are the tweaks to healthcare financing Singaporeans can expect in future:

- Medisave usage will be expanded to more medical conditions;

- Medishield coverage, renamed Medishield Life, will extend to those above 90 and will be universal. It will be expanded to include those with pre-existing illnesses;

- There is no opting out of Medishield Life and premiums will be higher;

- A “Pioneer Generation Package” will be introduced to help elderly Singaporeans in their late 60s and above pay for their premiums under Medishield Life;

- Medisave contribution rate will increase;

- State spending on healthcare will increase;

- The Community Health Assist Scheme will be open to younger Singaporeans below 40;

- Means-tested subsidies will be increased for those with more serious conditions who need to visit Specialist Outpatient Clinic

Details will be finalized after a public consultation exercise (reports here and here).

The Good News (Fingers Crossed)

Universal coverage under Medishield Life, to include even those with pre-existing health conditions, is a good move. It means that those who are currently uninsured due to their medical conditions do not have to worry about draining their cash savings to pay for their medical expenses.

Expanding Medisave usage to more medical conditions and for preventive health screening is also long overdue.

As many Singaporeans have observed, it is pointless to have so much money in our Medisave account if we cannot utilize it.

Singaporeans are already “over-saving” in Medisave, according to Prof Phua Kai Hong, an expert on healthcare policy at the Lee Kuan Yew School of Public Policy.

Prof Phua said that the level of savings is equivalent to about 10 years of our annual health budget, when in fact a savings level of between three to five years is adequate (“Government to take on larger share of medical costs,” Today, 28 Feb 2013).

Who Pays?

Now I know many readers are still skeptical of our government’s assurances, as I am.

While the healthcare changes outlined in the NDR speech sound reasonable, it is hard to say if the individual’s out-of-pocket healthcare expenses will actually be reduced till the finer details are confirmed.

As of now, the Medisave withdrawal limit for each premium (Medishield and Integrated Shield Plan) is up to $800 per insured person per policy year, and any sum above $800 has to be paid out-of-pocket.

How will the increased premiums under Medishield Life be funded?

PM Lee said that the state will spend more on healthcare. But he also said that the Medisave contribution rate will be raised.

In my earlier blogpost, I have pointed out that our out-of-pocket health spending is the highest among many developed economies.

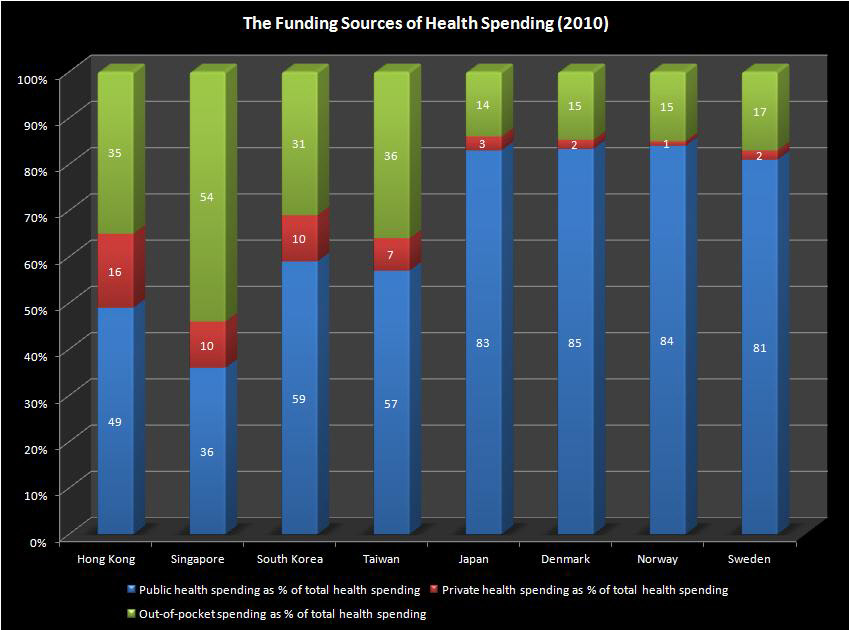

The chart below shows that Singaporeans’ out-of-pocket health spending as a percentage of total health spending is a staggering 54%, about 20 percentage points higher than that of Hong Kong, Taiwan and South Korea.

And this is not including funding from Medisave, which, technically, should be counted as out-of-pocket spending since it is a compulsory deduction from our income. In other words, our out-of-pocket health spending is in fact higher than 54%.

(Data sources: WHO Data Observatory, Taiwan & Hong Kong). Note that Medisave is not counted as out-of-pocket spending in the Singapore figure.

In view of the already heavy burden on the individual, therefore, I do not think Medisave contribution rate should be raised to fund the growing healthcare expenses, especially if this eats further into employees’ take home income.

Channeling more money from the CPF ordinary account to the Medisave account also does not lessen the individual’s financial burden. Considering that many of us are using our monthly contribution in the ordinary account to pay for our housing loan, such a move is as good as taking money from our left pocket to fill our right pocket.

On the other hand, increasing state spending on healthcare is only right, given that our public spending on health as a percentage of total health spending is very low in comparison to other East Asian economies. It is from 10 to 20 percentage points lower than our East Asian neighbors, and close to 50 percentage points lower than that of Japan.

It is high time our government takes on a bigger role in funding health spending in Singapore.