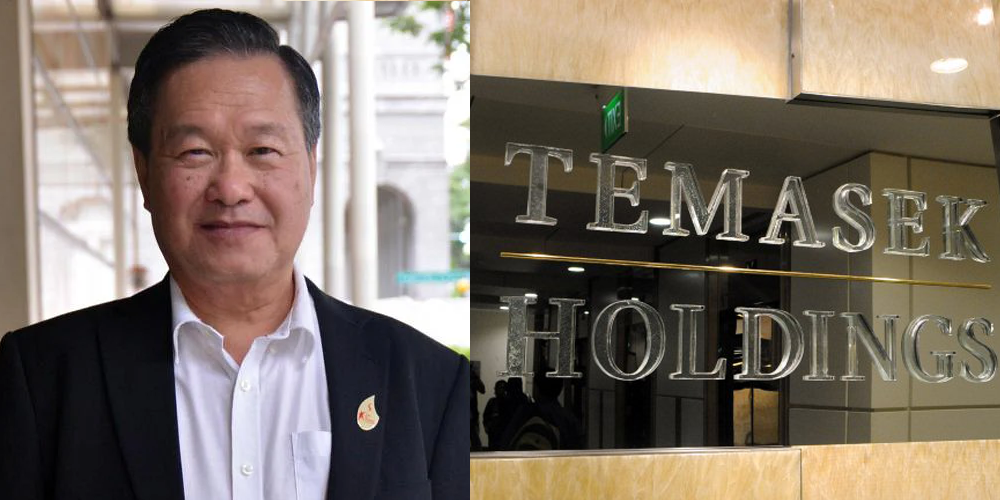

SINGAPORE — Mr Tan Kin Lian, former NTUC Income CEO, raises questions as to whether Temasek Holdings, Singapore’s sovereign wealth fund, was run like a venture capital and the transparency of its approval committee on its investments.

Mr Tan, in a Facebook post on Sunday, highlighted the disappointment expressed by many over the failed investment of US$275 million by Temasek in the defunct cryptocurrency exchange FTX.

Adding that these people were surprised and shocked by the realisation after FTX’s collapse that the entity was run by a team of young, inexperienced people, and there were no proper governance, accounting and risk management practices.

Less than a week after his appointment as FTX’s new CEO, John J. Ray III issued a scathing assessment of “unprecedented” poor management practices by his predecessor, Sam Bankman-Fried and listed a series of questionable financial activities in a filing to Delaware bankruptcy court.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” said Mr Ray in the document.

“From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.” said Mr Ray.

“An Opportunity Not To Be Missed” Mentality For Venture Capitals

Mr Tan, in questioning how Temasek carried out its due diligence before its investment in FTX, references the operation of the venture capital industry.

“The people in this industry that invest large funds into startup companies, such as FTX, form a closely knit community. They know each other personally through attendance at international conferences, business introductions and joint investments in ventures.”

“Often, a leading VC capitalist gets to know a startup entrepreneur and decides to fund the startup business. This VC capitalist introduces the startup to their close contacts in the industry, and probably describes it as “an opportunity not to be missed”.

“The other VC investors line up to get a share of this opportunity. They would probably not carry out their own due diligence, as it would take time, and the opportunity might go to other investors who are willing to decide promptly.”

Mr Tan, who has spent a few decades of his working career in the insurance industry, noted that this is also how the big insurers spread their risk through reinsurance.

“They follow the leader and take a share of the big risks, often based on trust that the leader has carried out the proper due diligence.”

The problem with this approach, said Mr Tan, is that the leading VC capitalist that brings “opportunity” to other investors might have a vested interest, e.g. they are paid a finder’s fee based on the investments made by new investors.

While Mr Tan is uncertain if this is the case for FTX, he pointed out that such finder fees can be quite hefty, and the payment would probably be considered legal.

Nevertheless, he considers it to be a bad practice for an institution to make a significant investment based on this practice of following the leader blindly.

Temasek, in a statement on 17 November about its FTX investment, blamed its founder and former CEO, Mr Sam Bankman-Fried, “It is apparent from this investment that perhaps our belief in the actions, judgment and leadership of Sam Bankman-Fried, formed from our interactions with him and views expressed in our discussions with others, would appear to have been misplaced.” (emphasis ours)

It said it had expected FTX to act ethically always, “We expect companies that we invest in to comply with their obligations under the laws and regulations of jurisdictions in which they have investments or operations; abide by sound corporate governance; and above all act ethically always.”

Bad Practice For Investment Committee To Consist Only Of Full-Time Management, Says Mr Tan

Many large hedge and institutional funds are involved in FTX. While Temasek was not the leading investor and not the largest investor, it was the second-largest outside investor on the capitalization table.

Mr Tan hypothesised that the portfolio manager did not make the decision to invest in FTX without consultation. This would have to be approved by an investment committee he expects to include members of the non-executive board.

However, based on information he was able to obtain, he noted that Temasek’s Senior Divestment and Investment Committee (SDIC) seems to comprise solely of the full-time management and does not appear to include the non-executive board directors.

The annual report also did not disclose the names and positions of members of SDIC.

“I think that this is a bad practice that needs to be corrected. Some non-executive members of the board should sit in the SDIC. Their role is to check that the full time managers are doing their work diligently.”

Last Wednesday (30 Nov), Deputy Prime Minister and Finance Minister Lawrence Wong announced in Parliament that Temasek would be conducting an internal review of its FTX investment.

Mr Wong noted that a team within the sovereign wealth fund, separate from the investment team that decided to invest in FTX, would conduct the internal review.

The review is said to be intended “to study and improve its processes, and to draw lessons for the future”.

Mr Tan said he will wait to read the findings of this investigation.

“I hope that it will be released in full and quite promptly.”