by Value Penguin

The Association of Banks in Singapore published a proposal on 4 December to improve the way it calculates SIBOR. SIBOR stands for Singapore Interbank Offered Rate, and is simply an interest rate that banks in Singapore charge to one another. While that may sound like it is completely irrelevant to everyday consumers in SIngapore, it actually could have some significant implications for them. This is because most loans, especially home loans, in Singapore are priced in relation to how high or low SIBOR is. Therefore, consumers can gain from understanding how the SIBOR calculation is going to change and how this change could impact their lives.

SIBOR’s volatility could increase

According to the major media coverages of this topic, one major change that ABS is planning to institute is to incorporate more market transaction data to help price SIBOR more efficiently. For example, SIBOR could reflect all of banks’ funding activities like bonds instead of only reflecting interbank lending. It seems that authorities want SIBOR to adjust more quickly to local transaction data and global market changes.

To understand why this is happening, it’s important to be aware of the historical context around interbank lending. A lot of major banks all over the world have been getting caught red-handed while colluding to fix interbank lending rates for their own benefit. For example, the Monetary Authority of Singapore caught 20 banks rigging key borrowing and currency rates in 2013. Similar cases have been revealed in other major markets like Japan and the UK in recent years as well.

Essentially, banks all over the world have been colluding to keep their funding cost stable. And to prevent these illegal activities from continuing, authorities in Singapore are now integrating live market data in determining what interest rates should be, while reducing the impact of “expert opinion” to prevent market fixing. While this definitely creates a more transparent process, what it could also cause is increase volatility of SIBOR since it’ll expose SIBOR to more unpredictable market forces.

Interest rates are rising globally

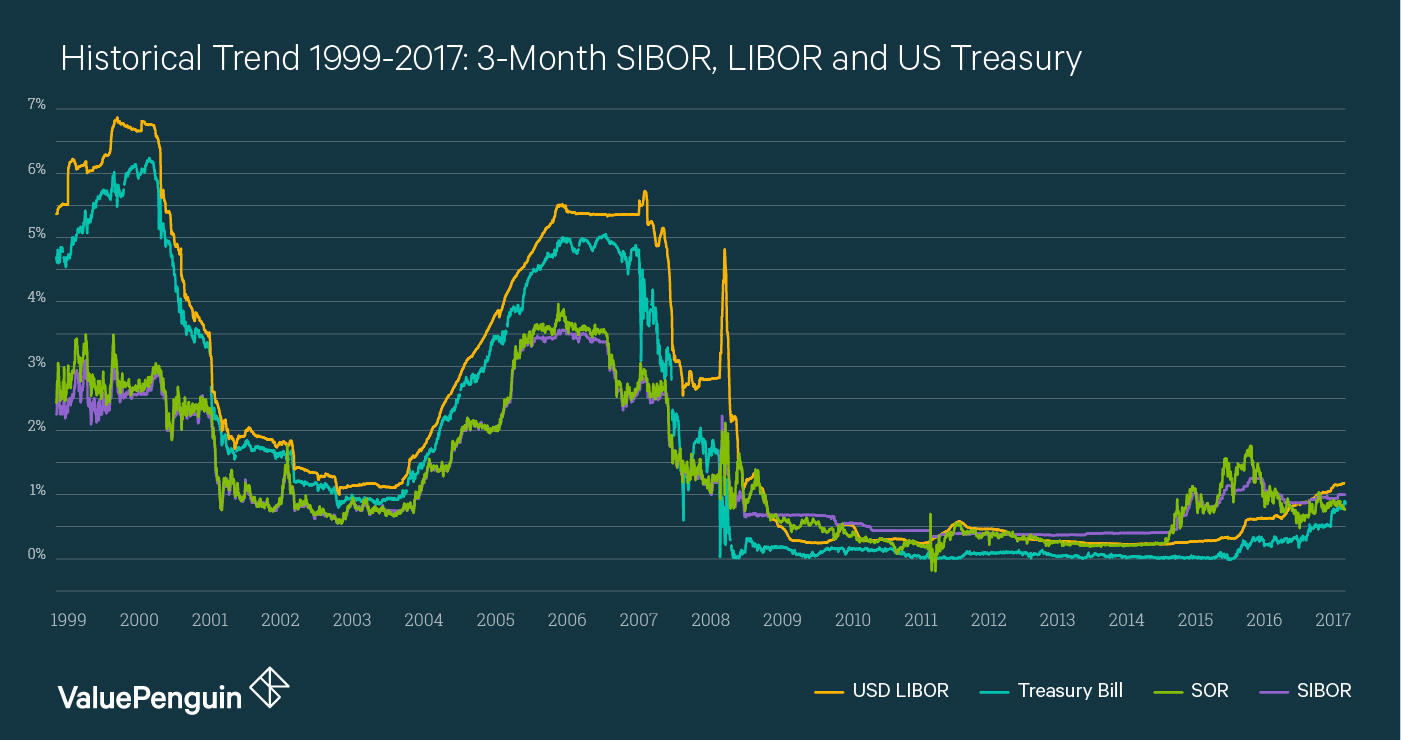

While increased volatility of SIBOR in of itself isn’t necessarily harmful or beneficial to everyday consumers, it does have an impact on Singaporeans because market rates are expected to rise. The fact that SIBOR is going to reflect market forces more efficiently and dynamically means that it will adjust more quickly if rates in other major markets rise. We’ve written previously about how the correlation between SIBOR and US interest rates have fallen in the recent years. With this new adjustment, it is likely that this correlation will pick back up.

This means that the cost of borrowing could increase more rapidly for an average Singaporean borrower. Rates have been at historic lows globally, and many consumers have been enjoying higher consumption than they could afford because they could get cheap financing options. As U.S. rates are set to rise for the next few years, a quicker adjustment in SIBOR means that Singaporeans now have more urgent needs to adjust their balance sheets by refinancing or repaying their loans more quickly.

It’s not all bad

However, a more efficient SIBOR calculation isn’t necessarily bad. In fact, it also has its own set of positives. For instance, a SIBOR that adjusts more quickly to global markets means that SGD’s exchange rate could be more stable. It could also mean that savers could potentially earn higher yields on their investments and savings accounts. Regardless, the most important thing is that you are aware of all of the potential consequences of this upcoming reform, so that you can better prepare yourself to face any challenges or opportunities with a plan. When it comes to personal finance, understanding and planning is half the battle.

This was first published at Value Penguin’s website, “SIBOR Reform: Potential Implications for Singaporean Consumers“.