Ash Tong / Guest Writer

I have always taken great discomfort, when MSM and biased marketing talk always refer to the pricing of new flats as “Discount to the market” or “Cheaper than comparative condominiums in the area’.

I have always taken great discomfort, when MSM and biased marketing talk always refer to the pricing of new flats as “Discount to the market” or “Cheaper than comparative condominiums in the area’.

The Ang Mo Kio and Bishan projects are priced at above $400,000 for a new 4 room flat, applicant for these projects are subjected to the $8,000-income cap. A simple break down of the math.

Gross Income: $8000

CPF: $1600

CPF into OA for housing needs: $1082.56

Nett Cash: $6400

4 room Natura Loft project in Bishan: 465k

Monthly installment based on 30 years 2.6% calculation: $1861.38

Hence each family would have to top up $778.82 into their CPF for their housing each month, which makes up to 12 per cent of their disposable income. If you change the calculations for a 20-year repayment, the percentage of their disposable income used to top their CPF moves into the 20 per cent range.

Ideally, all applicants for these projects would have a perfect gross income of 8k, and the flats would be affordable. However, often couples with incomes below 8k, might be unsuitably stretched, by buying such flats.

As a side note, it should be no surprise that this project was awarded to the highest tender.

CPF housing grant for family living within 2km are only eligible for DBSS projects, and additional housing grants are only eligible for families who earn below a $4,000 gross income. Given the number of DBSS projects that have been released in the past year, it defeats the purpose of encouraging families to stay at close proximity as it comes with a huge price because these projects cost 400k and upwards. I do not recall any Non-DBSS projects in mature estates released in the past year.

The additional housing grants equates to lip service as no sane couple could afford a DBSS project with a 4k gross income.

All other new flats are not eligible for any grants as they are sold, “at a great discount”. The argument would not hold, when we look deeper into the figures; e.g. a new Toa Payoh Central Horizon flat cost up to 550k for a new 5 room flat, using the PSM or PSF to compare with resale flats will show that these flats are not priced at discount at all.

Now lets not be choosy as Singaporeans, HDB is trying their best to give us a home.

So we turn to non-mature estates like Punggol. Yet again, we’re subjected to manipulated pricing.

I refer to the latest BTO project, Punggol Arcadia offered by HDB.

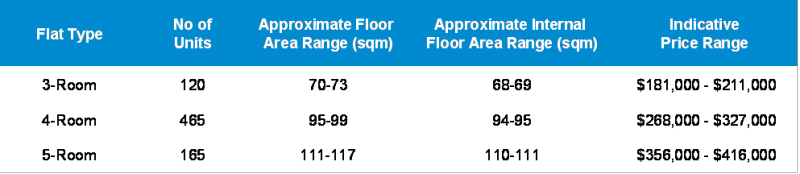

In a similar location just across the street, Coralinus/Treelodge@ponggol BTO project, indicative prices taken from October Half yearly Sale:

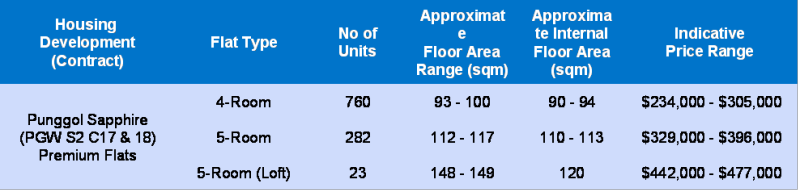

In another location with similar proximity to Ponggol MRT, released May2008:

These 3 projects all hold the same proximity to Ponggol MRT station, and are all touted as premium projects. However we should question why the indicative price range has risen from between 7 per cent to 14 per cent? The internal floor area has all but gone up by less than 2 per cent comparatively. I have only drawn the comparison for 4 room flats, but similar directional trend can be noticed in 3 and 5 room offerings as well.

According to news reports, commodities have gone down, demand for construction might slowdown hence might require government reversal in placing some infrastructure projects on hold; so why the increase in prices for such flats?

Minister for National Development, Mr Mah Bow Tan, once said something along these lines. “Instead of building in sync with population growth, which resulted in several excess of flats, we shall now build in sync with demand, hence the BTO model.”

Doesn’t that mean demand will always exceed supply; hence the price floors/equilibrium prices for new flats will be artificial?

Can these directives by HDB be considered duress?

Quoted from their press release:

”The above measures will encourage applicants to consider their options carefully before participating in a HDB sale exercise. They will also help to minimize non-selection of HDB flats by applicants who repeatedly participate in sales exercises and thus divert HDB’s time and resources from those with urgent housing needs.”

This press release was in reference, to the change of rules for balloting of flats. However in the latest October half yearly sale, a 20-year old Bedok flat was also offered in the ballot. Half yearly sales do not allow applicants to choose the indicative area they prefer, nor do they allocate married child priority since applicants are unable to indicate the areas they prefer.

So one does wonder, if the applicant whose family nucleus is in the west, is invited to select a flat and this particular Bedok flat is the last choice available, does one fault him for non-selection?

We are made to pay even for the basic automated electronic process of balloting, yet HDB’s stand seems to infer that if we need a house we should take what they offer. As mentioned, we do not pay a discount, and HDB does make a profit from selling the flats, so why should we be penalized for being selective when we buy our flats?

A home to an ordinary Singaporean like me should be a nest of warmth where I return to my family every night, yet it seems to have been turned into a monopolistic business model, with minimal sense of ownership given.

I do also wonder what HDB’s urgent housing needs refer to, as all I see is an unnecessary spate of DBSS and overpriced projects.

——