by Nivrita Ganguly

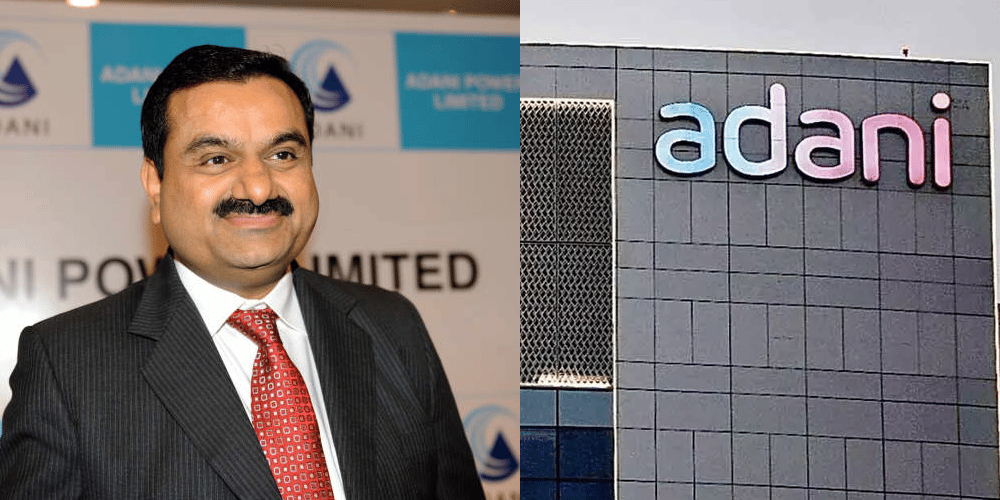

Mumbai, India — India’s beleaguered Adani group cancelled a US$2.5 billion share sale Wednesday, with the embattled tycoon saying it would not be “morally correct” to continue after his flagship firm’s share price slumped even further.

The group has suffered a five-day rout following explosive allegations of accounting fraud by US short-seller Hindenburg Research.

It has wiped out around US$92 billion of the value of the conglomerate’s listed units, Bloomberg News said, while Adani’s fortune has collapsed by more than US$40 billion.

The sale of shares in Adani Enterprises had been intended to raise funds to pay down borrowing and broaden its shareholder base.

But small investors stayed away as the market price dropped below the offer range, and it was only fully subscribed after support from Abu Dhabi-based International Holding Company and, according to Bloomberg citing unidentified sources, fellow Indian tycoons Sajjan Jindal and Sunil Mittal.

Even so, Adani Enterprises’ share price suddenly dropped further on Wednesday afternoon, closing 28.45 per cent lower on the Mumbai stock exchange.

The trigger was news that Swiss banking giant Credit Suisse had stopped accepting Adani bonds as collateral for loans it advances to private banking clients, Bloomberg reported.

The Adani Enterprises board said in a late-night statement it had decided not to proceed with the share sale “in the interest of its subscribers” and all payments would be refunded.

Adani himself added that the market had been “unprecedented”.

“Given these extraordinary circumstances, the company’s board felt that going ahead with the issue would not be morally correct,” he said, insisting: “Our balance sheet is very healthy with strong cashflows and secure assets.”

The slide in Adani’s personal wealth has dropped the school dropout billionaire off the top 10 real-time Forbes rich list and seen him overtaken as Asia’s richest man by fellow Indian Mukesh Ambani.

Adani Total Gas — in which French giant TotalEnergies owns 37.4 per cent — dropped another 10 per cent on Wednesday, forcing the Bombay Stock Exchange to suspend trade in the stock soon after the market’s open.

Adani Ports dropped almost 18 percent, while Adani Power and Adani Wilmar fell five per cent each.

1,000 percent

Publicity-shy Adani, 60, has seen his empire expand at breakneck speed, with shares in Adani Enterprises soaring by more than a thousand per cent over the past five years.

This helped make him, as of last week, the world’s third-richest man behind Elon Musk and Bernard Arnault and family.

According to Hindenburg Research, Adani has artificially boosted the share prices of its units by funnelling money into the stocks through offshore tax havens.

This “brazen stock manipulation and accounting fraud scheme” is “the largest con in corporate history”, Hindenburg said in its report.

Even before the document, there were concerns that Adani had taken on too much debt.

Adani said it was the victim of a “maliciously mischievous” reputational attack and issued a 413-page statement on Sunday that said Hindenburg’s claims were “nothing but a lie”.

Hindenburg, which makes money by betting on stocks falling, said in response that Adani’s statement failed to answer most of the questions raised in its report.

Opposition heckles

Critics say Adani’s close relationship with Prime Minister Narendra Modi has helped him win business and avoid proper regulatory oversight.

Modi, who like Adani is from Gujarat state, has not commented publicly since the Hindenburg claims, which analysts say has hurt India’s image just as it seeks to woo overseas investors away from China.

The firm’s many interests include ports — the firm took control of one of Israel’s biggest this week — telecoms, airports, media and energy, both in coal and renewables.

India’s opposition Congress party called this week for a “serious investigation” by the central bank and regulator into Adani’s firms following the Hindenburg allegations.

“For all its posturing about black money, has the Modi government chosen to turn a blind eye towards illicit activities by its favourite business group?” Congress said.

Opposition lawmakers mockingly chanted “Adani! Adani” on Wednesday as Finance Minister Nirmala Sitharaman talked about ports during a budget speech.

— AFP