Given the global supply chain disruption and the overreliance of the world on China as a manufacturing base, it is about time that Singapore brings manufacturing back to 25 per cent of the economy, said international industrialist and former People’s Action Party (PAP) Member of Parliament (MP) Inderjit Singh.

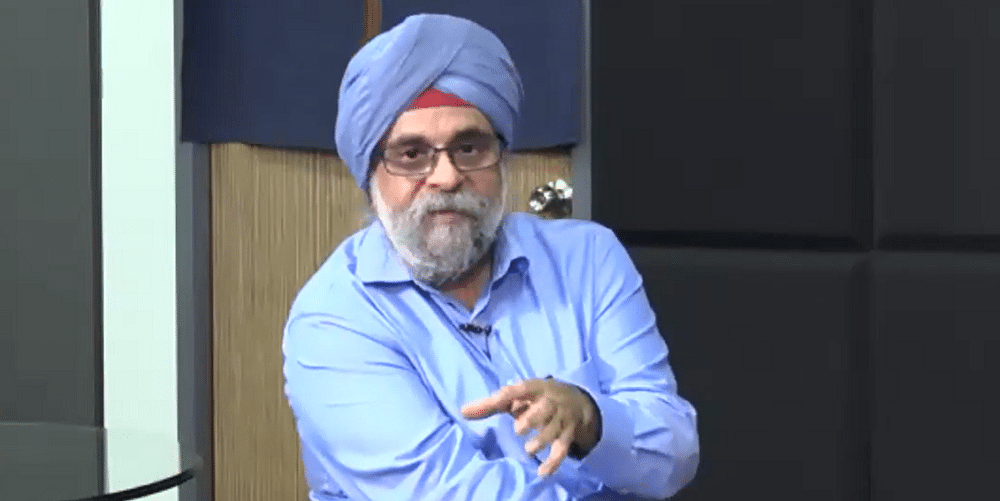

Mr Singh was among the panellists in the webinar titled, “The Future and Challenges to the Singapore Economy”, organised by the Future of Singapore (FOSG) via Zoom on Saturday (17 Apr).

The webinar touched on the fractured global economy with Singapore caught between the US and China blocs, disruptive technological revolutions to jobs and global supply chains in artificial intelligence (AI), the internet of things, 3D printing as well as future pandemics.

He noted that the COVID-19 has triggered a “serious” disruption on the global supply chains, and highlighted the overreliance of many countries on China as “the factory of the world”.

“This triggers me to think about whether we can bring manufacturing back, which was our core strength many years ago,” said Mr Singh.

He explained that Singapore’s economy was at 28 per cent in the 2000s, during which the city-state has been “very successful”, considering that both Taiwan’s and Korea’s share of manufacturing of their GDP was also at 30 per cent.

However, Mr Singh said that Singapore started “giving up” on manufacturing as it shifted to become a service-based economy.

“The sad part was that we had core competency. For example, in the area of semiconductors, we were very strong. We had many local companies, we had GLCs that were also in the semiconductor industry.

“But we sold those out and we lost competitive advantage, which resulted from the Government’s economic policy for shifting too quickly from one area to another,” he noted, adding that the Government could have focused on the semiconductor industry instead.

With the current development in technologies, Mr Singh opined that manufacturing can be viable even in a country like Singapore.

He noted that while Singapore cannot be a mass-production player like China and other bigger countries, it can venture into certain areas of manufacturing that could be a viable component of the economy, such as the semiconductor industry.

“This is one area I think we should rush to get back into by acquiring some players around the world,” Mr Singh remarked.

Mr Singh went on to highlight that Singapore is spending S$25 billion in the next five-year plan for research, innovation and enterprise (RIE).

Though the Government has spent billions in research and innovation, which have produced good results, he noted that they have not been commercialized.

“As we look at making manufacturing work again and also in bringing our technology out to the market – this is what I meant by prototyping, commercializing the technology – we have that capability.

“We have a manufacturing background, many PMETs who are out of the industry who actually can help to do this. So how can we bring some of these people with the Government support funding in the right places to bring this technology to the next stage of prototyping and initial production?.

“Some of these could become large-scale production. But if we can look at every area of technology and create prototyping factories for many of these, then Singapore can become the prototyping factory of the world,” he said.

Mr Singh explained that being a prototyping hub will enable Singapore to be involved in the value chain and the mass production stage.

“Let’s bring it back to 25 per cent of the GDP and focus in the area of commercializing and big prototyping, and bringing it up, working with our neighbours and then we become a value provider for all of them,” he noted.

By doing so, Singapore will be able to create more value-added jobs, without having to bring in low-cost labour which “we are used to”, said Mr Singh.

S’pore Govt to focus on supporting local SMEs, instead of getting “some licensing revenue”

During the webinar, Mr Singh also highlighted that the Government is not supporting the local SMEs like the way that it supports the Multinational Corporations (MNCs).

“The EDB deploys resources to bring in multinationals, but they are not doing the same thing to support our SMEs. I think if we don’t do it now, we will see a complete collapse of our economy,” he remarked.

Citing an example, Mr Singh shared about a research professor in NTU who took an Intellectual Property (IP) license in Singapore to start a prototyping facility to productize his technology.

But instead of starting his prototyping in Singapore, the professor moved to Shangai due to the financial and infrastructure support available in Shanghai.

“This is something that we could have done here. We could still go and do mass production in China someday because that’s where the market is, but we lost that opportunity because we did not focus on doing that portion of it,” he noted.

Mr Singh wrote in his policy paper: “I would urge that the Government makes this a national priority – to fund and support and encourage productization and commercialization of technologies that are developed in Singapore’s universities and research institutions.

“Having a prototyping centre will enable us to capture some value from our IP, instead of them being licensed directly to entities abroad, for which the returns to us become substantially diluted. With the China-US trade war, an allegations of IP theft, Singapore would become an important source of IP for China.”