by Value Penguin, Mary Leah Milnes

Travel insurance may not be as cut-and-dry as you might think. Keep reading to see if you’ve fallen prey to the top 9 common myths and misconceptions about travel insurance.

1. Travel insurance is unnecessary

You might think that travel insurance is nothing more than another clever scheme cooked up to part you from your money, and is unlikely enough to come in handy that it’s not worth going to the trouble to buy. But the chances that you’d be mistaken seem to be rising. According to claims data published by AIG Singapore in a 2017 report, “high-impact incidents” such as extreme weather conditions, medical outbreaks, or even sociopolitical events like terrorist attacks are 85% more likely to happen on your next vacation out of Singapore than only 3 years ago. And apparently, the number of claims AIG has received in the last three years resulting from sociopolitical causes such as political instability, terrorist attacks, coup d’etat or stricter border security have more than doubled compared to previous periods. Overall, AIG considers these high-impact incidents the top emerging risk for Singaporean travellers this year.

What do extreme weather conditions, medical outbreaks and terrorist attacks have in common? They cannot be expected or anticipated and they are highly disruptive and large-scale. As such, you can’t realistically prepare for something like the Zika outbreak of 2016, which took the world by surprise. But you shouldn’t lock your doors and consign yourself to a life without further overseas travel. Instead, consider buying a travel insurance plan, which will help you deal with the prodigious expense of procuring emergency medical assistance or evacuation should something happen on your trip at a very low comparative cost.

2. Travel insurance is too expensive

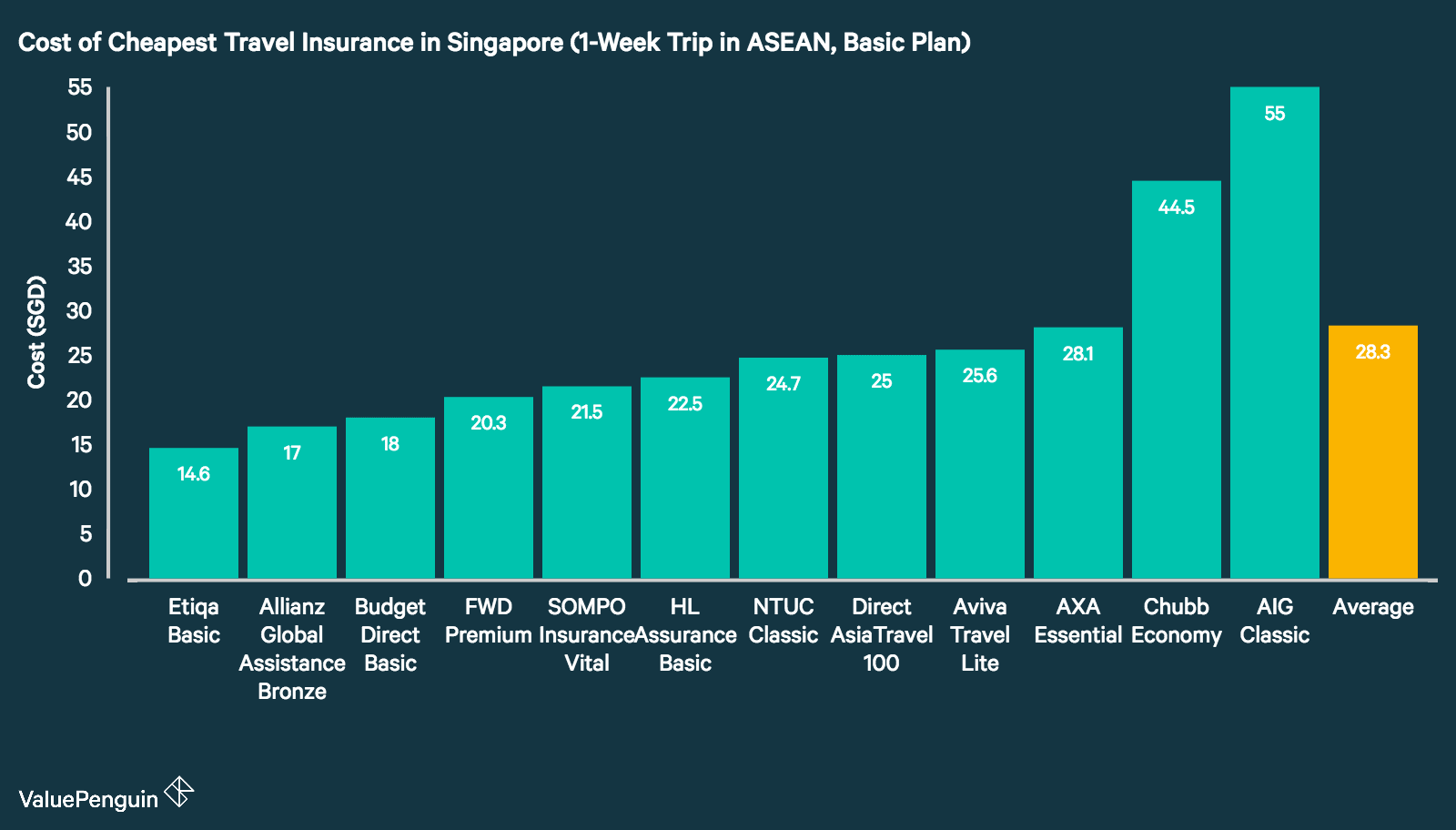

Another common misconception about travel insurance is that it’s just too expensive. There is a grain of truth here: some insurers do charge fairly high rates that could definitely make you think twice about whether buying a plan is really that vital. But the fact of the matter is that there are a plethora of extremely affordable travel insurance plans out there that will give you great coverage without costing an arm and a leg. The trick is simply deciding to dedicate the time to finding them. The best travel insurance plan for your needs may not be sold by the most famous or well-known insurer, and finding it may require that you do a bit of digging.

The good news is that it’s now easier than ever before to get objective, detailed information on your many travel insurance options to help you make the best decision. Our team at ValuePenguin has studied the Singapore travel insurance market in-depth to find the best budget travel insurance plans, the best value-for-money travel insurance plans, and the travel insurance plans with the best coverage with the aim of helping consumers figure out what they need and which policy best meets those needs. If you want to learn more about how all the travel insurance plans in Singapore stack up, consider reading our lists of the best travel insurance plans in Singapore for 2017.

For as little as S$20, for example, you can guarantee yourself hundreds of thousands of dollars in medical expenses and emergency medical/evacuation/repatriation coverage during your 1-week trip to ASEAN countries like Malaysia or Thailand. Such a plan will have a negligible long-term impact on your wallet while conferring extensive peace of mind as you know you’ve done the responsible thing by insuring your travel.

3. It’s probably cheaper to pay out of pocket anyway

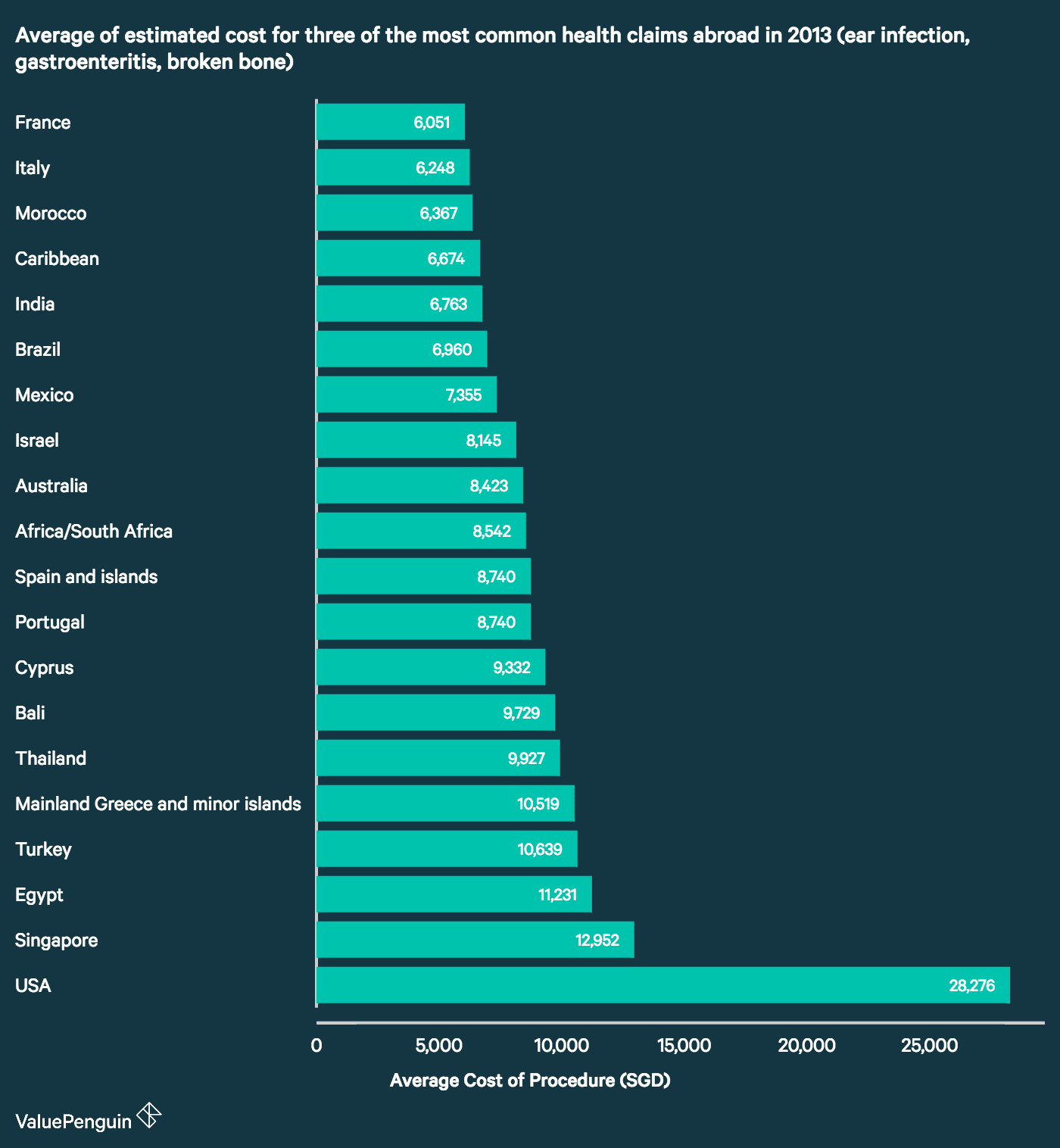

You may have heard it from the grapevine that hospital expenses in third-world countries like Thailand or Mexico are so cheap that you may as well just pay out of pocket for any medical expenses you incur while abroad rather than paying ahead of time for coverage you might not end up using. But don’t make the mistake of underestimating the cost of replacing lost or damaged essential items or the cost of medical expenses in your destination country. Even an accident as mundane as slipping in the shower and breaking a bone or getting a sprain could run you into the many thousands of dollars. The average estimated cost of three of the most common health claims abroad (ear infection, gastroentiritis and broken bones) is over S$7,300 in Mexico and nearly S$10,000 in Thailand. And don’t even think about traveling without insurance in a country like the United States, where this could cost over S$28,000 out of pocket.

4. You only need travel insurance for high-risk holidays

If you’re relatively new to travel insurance, you might think that you only really need it if you’re an adrenaline junkie who spends his time bungee jumping in Nepal or whitewater rafting through Victoria Falls in Zimbabwe. But just because you don’t have a death wish doesn’t mean you can’t benefit from a travel insurance plan, too. Travel insurance offers you a whole lot more utility than just coverage for adventure sports and other high-risk activities. It can, for example, compensate you for the inconvenience, lost time and stress caused by something as simple as your baggage getting delayed en route to your destination or you getting bumped off your flight due to its being overbooked. You’ll even find that some insurers will throw in special perks like VIP lounge access at the airport, wifi vouchers, and even hole-in-one rewards in addition to coverage for your golf equipment. The more research you do on your options, the more you may be surprised by what you’ll find travel insurance coverage can include.

5. Annual travel insurance isn’t worth the money

In the worst case scenario, an annual travel insurance plan in Singapore could cost as much as S$758 (Chubb). You’d be forgiven for thinking that paying that much for an annual travel insurance policy is definitely not worth the cost. However, you should be aware before casting judgment that there is a massive degree of variation in how much annual travel insurance plans in Singapore can cost. If you do your homework, you can buy even a premium-tier travel insurance plan that will insure you for travel within ASEAN for as little as S$178.2 (Etiqa) or for travel all around the globe for only S$291.2 (HL Assurance). And you’ll find that if you’re a frequent flyer who travels out of Singapore more than about 3-4 times a year, you can quickly end up saving a lot of money buying one annual travel insurance plan that covers all your trips out of Singapore as opposed to multiple single-trip policies.

6. Your health insurance in Singapore will cover medical expenses abroad

You may think that travel insurance’s coverage for medical-related expenses is redundant if you already have health insurance in Singapore. But you should be aware that while your health insurance plan may totally cover you locally, it may not cover you for medical expenses abroad, particularly emergency medical evacuation should something go badly wrong while you’re overseas. Before making your decision on whether to buy travel insurance, carefully scrutinize your health insurance plan so that you are absolutely certain when and where you’re covered, as well as what procedures you might need to go through to make sure your health insurance provider will accept your claims.

7. Travel insurance will always have your back if something goes wrong

Obviously, travel insurance is there to protect you against unforeseen problems. But that doesn’t give you free rein to cast reasonable caution and common sense to the winds. Insurers will tend to reject claims that result from accidents or incidents caused by your negligence or recklessness. So if, for example, you miss your flight due to oversleeping, fail to get the appropriate recommended vaccinations before your trip, or knowingly travel to a destination experiencing significant political or civil unrest, don’t expect your travel insurance plan to cover you. Thankfully, the latitude for what sorts of activities you can partake in while abroad while still being covered has widened in the past few years, as more and more travel insurance providers expand their plans to include coverage of relatively risky activities like winter and water sports, bungee jumping, skydiving, and more. If you do plan to be a little adventurous on your next trip, make sure to buy a travel insurance plan that clearly states it will accommodate your adrenaline rush.

8. Your credit card or bank’s travel insurance is always sufficient

Some banks or credit cards may include a certain degree of complimentary travel insurance coverage. This is undoubtedly a nice perk. But don’t be fooled into thinking these travel insurance plans will necessarily give you the amount of protection you really need while abroad. Even the HSBC Visa Infinite Credit Card, an invitation-only premium card, has a built-in travel insurance, for example, gives you up to S$100,000 of coverage for overseas medical treatment and up to $250,000 for emergency evacuation and repatriation. This is an extremely low coverage level compared to most stand-alone travel insurance products, which you can see if you check out our in-depth comparison of the top travel insurance plans in Singapore.

9. You can report mishaps once you’re back in Singapore

If you get robbed while on your trip or some other mishap occurs, it’s crucial that you report the incident immediately – in the next 24 hours – to the local police and hold onto any resulting documentation if you want to set yourself up well to make a persuasive claim to your insurer. Sure, it might be a hassle to take time while in the middle of your holiday to bother with it, but doing so could end up saving you a great deal of inconvenience and expense.

This article was first published at ValuePenguin, “Top 9 Myths About Travel Insurance“